Happy New Year!

Let’s make 2025 our best year for trading yet!

I’ve said ‘best’ which some readers might interpret as equivalent to ‘most profitable’. But that’s not actually what I mean.

Our success (or lack thereof) in financial markets this year depends on two things

1.Ourselves

2.The markets

We can control the first but not the latter.

Like most things in life, we can control the inputs but we can’t control the outputs. The inputs are our consistency, work ethic and personal psychology. The outputs (ie the results of our trades) depend on the conditions in markets.

Last year the S&P 500 rose nearly 25%. That is massive. If you were buying US stocks, you probably had a good year. Likewise, it was a huge year for gold and Bitcoin. If you traded those assets - you are probably pretty happy with 2024. If those three markets go down this year and you’re still doing the same strategy that worked last year - the results likely won’t be so good.

That’s one of the reasons we try to trade both sides of the markets - we are bullish when the charts tell us to be and when the charts turn bearish so do we.

Silver (XAG/USD)

Silver is a market we’ve been bullish on in 2024 - and for now - we don’t see a reason to change that.

Yearly chart

We’re doing something a bit different here - partly because this chart involves a lot of past data that is not so readily available. This chart isn’t ours - it’s from GoldSilver.com - but we like it a lot.

As you can see, this is not a weekly chart. Each candle here represents one year.

This 'cup and handle pattern' suggests 2025 could close with silver well over $30 per oz.

The pattern includes a large rounded bottom (the cup) and a smaller rounded bottom after it (the handle). A breakout over the top of both (circa $30-31) could signal a new multi-year bull market in silver.

Down on the daily chart, the chart looks much less bullish and rather neutral.

Since its record high around $35, silver has dropped back under the $30 handle.

We see $30 as the threshold for whether to get bullish short term or not.

The next move over $30 will probably see a lot of choppiness and false moves. But even with a bit of extra bullish confirmation - and the price is maybe north of $31 or $32, it still leaves room to get long up to the all-time high - and perhaps beyond to trade the yearly cup and handle.

EUR/USD

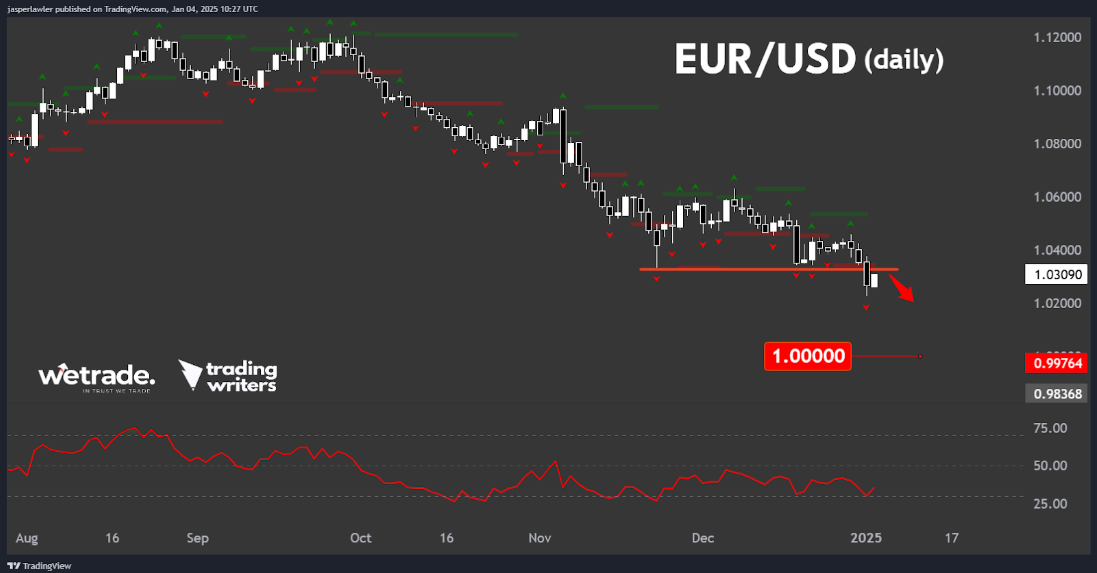

There are two good reasons to include EUR/USD in our analysis this week. First - it's the biggest highest volume market in the world - and second - it just broke down from multi-year support.

EUR/USD has closed the week below 1.05 for three weeks in a row and last week closed below 1.04.

Of course, this could be another false breakout. And if it is, that’s absolutely fine - we will get long with the price back over 1.05

But for now we are assuming it’s legitimate- and looking for short opportunities on the lower time frames.

On the daily chart, the line in the sand is 1.0300.

While the breakdown holds, we are looking to trade the euro down towards parity with the US dollar i.e. EUR/USD = 1.000.

EUR/JPY

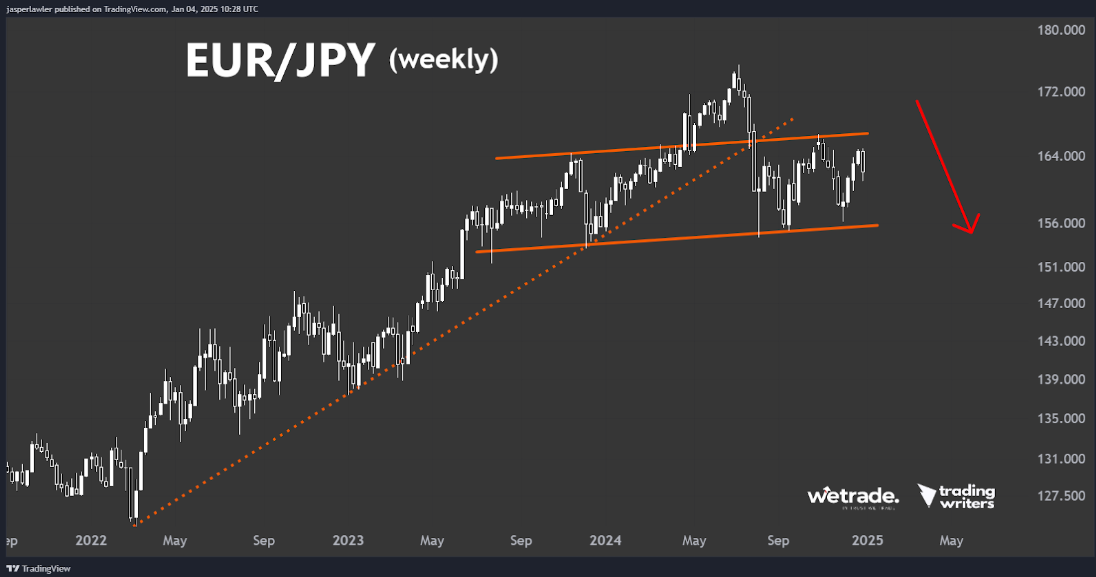

One of our favourite unresolved setups from 2024 going into 2025 is the POTENTIAL head and shoulders top in EUR/JPY.

A bearish engulfing pattern creating a lower high on the weekly chart has caught our attention as a possibly early entry trigger before the long term bearish pattern completes.

You can see the range market supported by a slightly rising trend line through the lows of the last 6 months.

The weekly bearish engulfing pattern has seen the price drop below a steeper rising trend line, potentially setting up a return to the flatter rising trend line.

Adding credence to this bearish view is the fact that RSI did not reach overbought levels on the latest peak, indicating the latest rally was not the start of a new long term uptrend.

But - as always - that’s just how the team and I are seeing things, what do you think?

Share your trading plan with us - OR - Request the analysis of any market you can trade on the WeTrade platform.

Send us an email or message us on social media.

Trade with WeTrade!

Every position closed is one step closer to unlocking WeTrade Honours privileges and redeeming exclusive rewards.

Start your trading journey here - Register now

Kickstart your trading of the week here - Login Now

Produced by Jasper and the Trading Writers team in collaboration with WeTrade.